Funding is the lifeblood of early stage fast growing startups. Whether you are selling goods online to consumers or a service to enterprise clients, your ramp up phase leading to cash break-even needs to be financed. This funding gap and how to close it efficiently is at the forefront of the list of worries any entrepreneur faces.

Often venture equity (in all its forms, whether angel, institutional, early-stage, mid-stage) is the only source of financing available until the startup has been de-risked to a level where debt funding becomes a second viable alternative. Venture equity is great for founders as it provides a source of capital that doesn’t need to be paid back, generally comes with connections and advice, and in certain instances, can provide a halo effect if the equity investor is prestigious.

Equity funding however is very expensive. Depending on the success of your business, equity investors can earn internal rates of return (“IRR”) in excess of 100%, sometimes even greater than 1,000%. This means that the founding team is paying those types of returns to investors in the form of dilution.

Whilst historically equity funding was the only viable funding option for startups, a Valerian Revenue-Based Advance provides a compelling alternative. With a Valerian Advance, your startup can finance digital marketing campaigns in a much more cost effective manner than if you used equity funding.

Digital marketing is a repeat expense that has a measurable ROI and a short payback. Rather than use expensive equity to fund this expense, a Valerian Advance can easily be accessed at the click of a few buttons, and has a fixed fee that is known in advance, guaranteeing that you keep full control of your cost of capital.

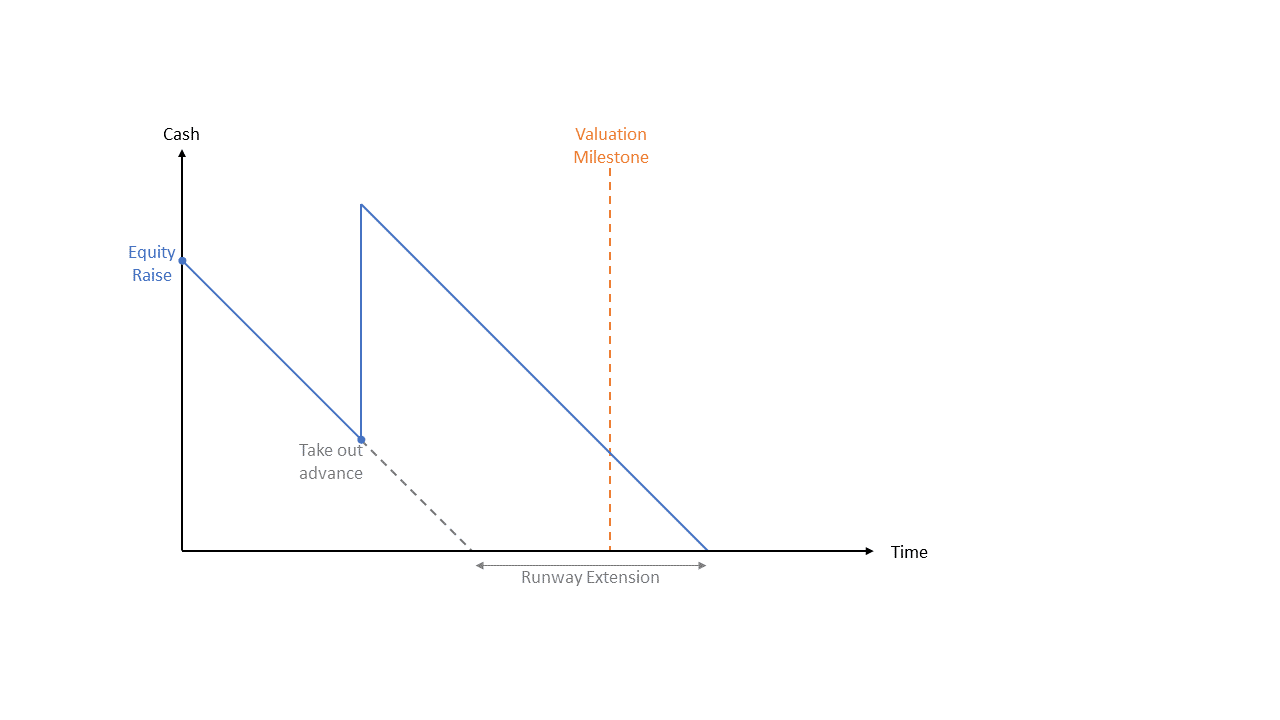

A Valerian Revenue-Based Advance is to be used as an ideal complement to an equity raise. With a Valerian Advance, you are able to extend your cash runway, which in turns allow you to better plan your growth, increase certainty of funding, and allow you to reach your next operational milestones, which can translate into higher valuation triggers.

Extend your cash runway with a Valerian Revenue-Based Advance

If your startup is at a point where debt funding becomes available, a Valerian Advance is still a superior option. This is because debt funding, whilst sometimes representing a cheap alternative, is very restrictive, both in terms of cash flows – fixed repayment schedule/covenants, onerous requirements on the founding team – personal guarantees/asset pledges, and in terms of complicating the capital structure – equity warrants given to debt holders.

In summary, a Valerian Advance provides a faster, more affordable and more convenient financing option for fast growing online businesses. This provides an invaluable edge in a world where competition is growing, distribution channels are increasingly becoming digital and where CAC’s are rapidly rising.

For more information on Valerian or to see if you qualify for an Advance, please visit: valerianfunds.com/getfunded